Ways to Give

All gifts make a difference in the lives of our students and their families.

There are many ways to give! Donations to IEA are tax-deductible to the full extent allowed by law.

IEA’s tax ID Number is #95-4695698

IEA’s fiscal year is January 1 to December 30.

check

Gifts to IEA may be made by check. Please make checks payable to the Institute for Educational Advancement and send to:

Institute for Educational Advancement

569 S. Marengo Ave.

Pasadena, CA 91101

ACH Bank Withdrawal

Make a secure donation online using electronic fund transfers directly from your bank account. This easy payment method has a lower transaction fee that makes your donation go even further.

Credit card

Using our secure server, make an online donation using Mastercard, Visa or American Express on the IEA Website. You may also call IEA and make a credit or debit card donation over the telephone (626) 403-8900.

stocks & securities

A gift of appreciated stock generally offers a two-fold tax savings; avoiding capital gains tax on the increase of the stock and providing an income tax deduction for the full market value of the stock at the time of the gift. For stock and wire transfers, please contact Carlos Zuniga at (626) 403-8900 or CZuniga@EducationalAdvancement.org in advance to receive current transfer instructions and to have your gift credited appropriately.

Donor Advised Funds

A Donor Advised Fund (DAF), which is like a charitable savings account, gives you the flexibility to recommend how much, when and how often money is granted to qualified charities. If you are currently using a Donor Advised Fund for your charitable giving, you can recommend a grant or recurring grants to IEA. Please contact your financial advisor if you are interested in creating a Donor Advised Fund.

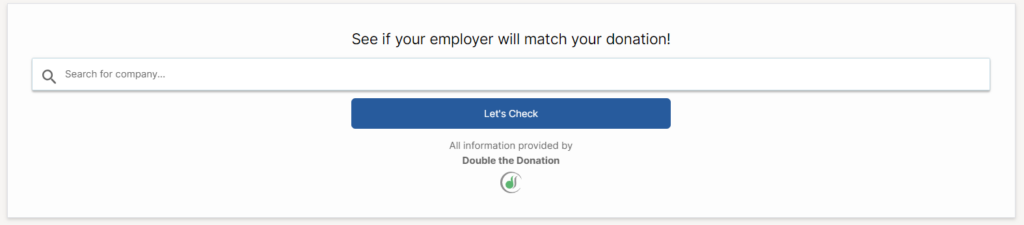

matching gifts

Many employers will match an employee’s donation. This opportunity presents an additional source of income for IEA and an easy way to leverage your gift into a larger donation.

Check if your company offers an employee match on Charity Navigator using the search bar under “What Are Employee Match Programs?”

honorary or memorial gifts

Gifts can be made in honor or memory of a friend or family member or in recognition of a significant event. Please indicate the name of the person or occasion in the comments section of the IEA online donation form or with your mailed check. You may also make an Honorary/Memorial gift by telephone (626) 403-8900.

planned gifts

Planned gifts such as bequests allow donors to give a lasting legacy and help to ensure IEA’s ability to serve gifted children for generations to come. Gift planning choices can also present practical options for safeguarding your financial security and realizing tax advantages. Click here to learn more about Planned Giving.

tax-free gifts from your ira

If you are 70½ years old or older, you can take advantage of a simple way to benefit IEA and receive tax benefits in return. You can give any amount up to $105,000 per year directly from your IRA to a qualified charity such as IEA without having to pay income taxes on the gift. This popular gift option is commonly called the IRA charitable rollover or a qualified charitable distribution (QCD for short).

Please contact your IRA plan administrator to set up a qualified charitable distribution.

For more information about Annual Giving, contact Jane Laudeman, Development Manager at (626) 403-8900 or jlaudeman@educationaladvancement.org.